GOVCON WEEKLY

Canadian Procurement Pulse: Your Weekly Contractor Insider

February Special Edition: NATO Procurement

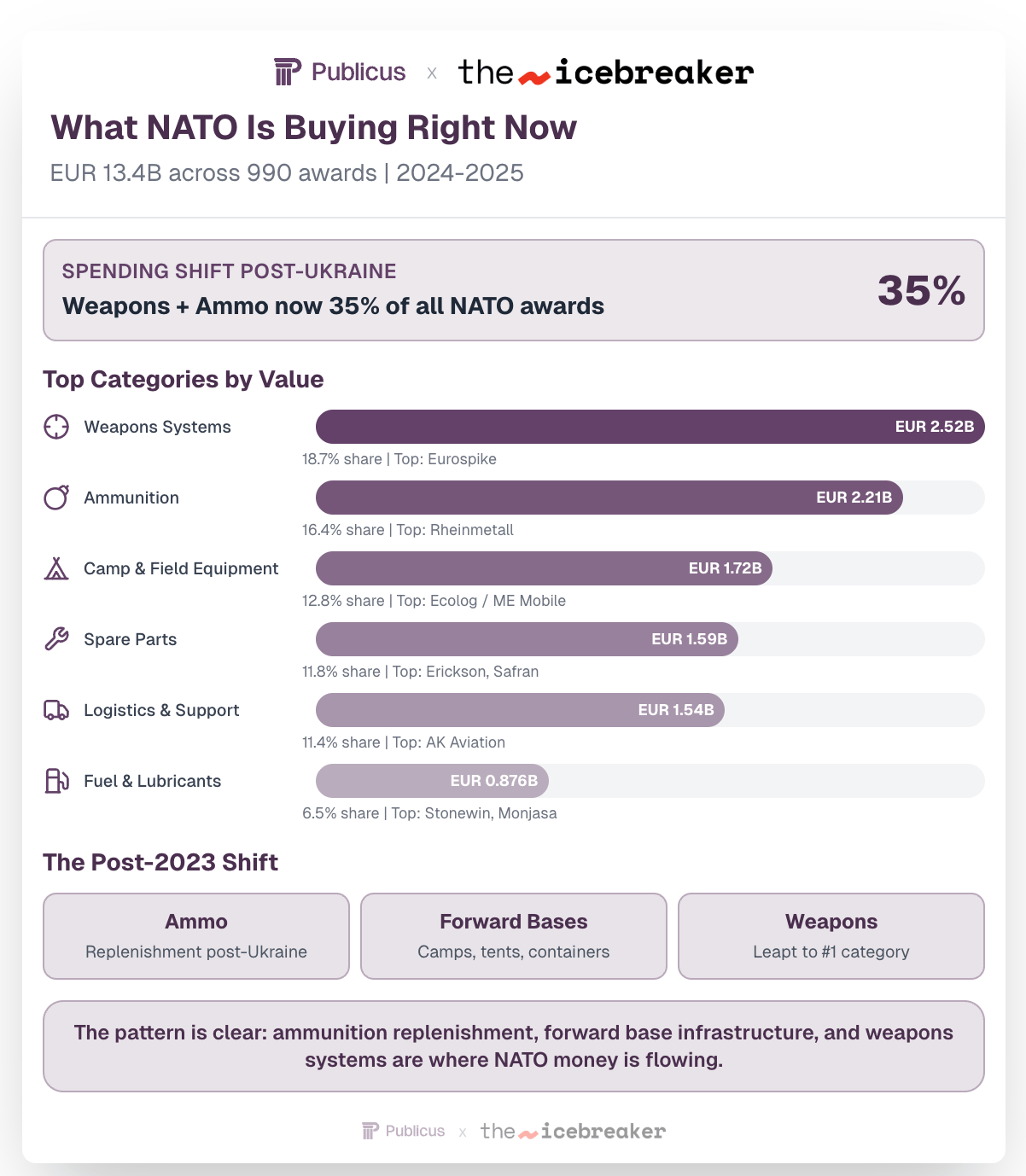

With defence spending dominating headlines and "Buy Canadian" in full swing, we pulled back the curtain on a market most Canadian contractors never think about: NATO procurement.

We analyzed 6,254 contract awards worth EUR 39.2 billion from NATO's Support and Procurement Agency (NSPA) spanning 2015-2025. The takeaway: NATO spending has tripled since 2020, Canada is dramatically underweight, and there are specific reasons why, along with specific opportunities for firms that understand the landscape.

How NATO Procurement Works (Quick Primer)

NATO runs two procurement agencies: NSPA (equipment, logistics, support) and NCIA (IT and comms). Our data covers NSPA only, meaning what countries chose to buy through NATO, not their total defence spending.

Why countries use NSPA:

Some nations with governance challenges use it as an arm's-length, third-party buyer for transparency

Collaborative programs (ammunition, shared fleet maintenance, coalition logistics) are more efficient when pooled

Members already pay NATO dues, so NSPA doesn't add extra procurement fees

Why European primes dominate the data:

Countries participate in NATO collaborative programs for ammo, the Boxer vehicle, TOW maintenance, and other shared capabilities

Nations can be "lead" or "participant" on these projects, funnelling significant value through firms like Rheinmetall and Nexter

Worth noting: Europe also has an EU procurement system (requires EU-built solutions, used heavily by Baltic and Eastern European states) and individual national systems. NSPA is just one of three overlapping channels.

NATO Spending Has Tripled Since 2020

Year | Total (EUR) | YoY Change |

2020 | 2.18B | — |

2021 | 4.10B | +88% |

2022 | 2.21B | -46% |

2023 | 4.79B | +117% |

2024 | 6.98B | +46% |

2025 (YTD) | 6.46B | On pace to exceed 2024 |

2020-2024 CAGR: 24.2% | Total growth: +220%

The 2022 dip reflects a planning gap as NATO pivoted from existing programs to urgent Ukraine-related requirements. The 2023-2024 surge is those new commitments translating into signed contracts. This is the most significant sustained procurement increase since the Cold War.

Biggest Vendors Today

Rank | Vendor | Country | Value | Winning |

1 | Eurospike GmbH | Germany | 2.0B | SPIKE missile system support |

2 | Rheinmetall | Germany | 1.09B | Ammunition (27mm, grenades) + spare parts |

3 | KNDS Ammo France | France | 507M | 40mm cased telescopic ammunition |

4 | Ecolog | Germany | 430M | Temporary camps, logistics |

5 | AK Aviation | Greece | 393M | Firefighting aircraft wet lease |

6 | Erickson Inc | USA | 361M | Heavy lift firefighting helicopters |

7 | Polaris UK | UK | 345M | ATVs and accessories |

8 | ME Mobile Energy | Germany | 330M | Temporary camps/energy |

9 | AeroVironment | USA | 291M | Raven/Puma UAS (drones) + logistics |

10 | Stonewin SIA | Latvia | 290M | Naval fuel |

Germany Is Pulling Away

Germany captures 35.4% of 2024-2025 NATO procurement (EUR 4.76B), up from 22.9% historically. The U.S. dropped to #2 at 9.6%. Canada sits at #20 with EUR 44M (0.3%).

Canada's Position: #11 Historically, Slipping Further

Over the full 2015-2025 period, Canada holds EUR 842M across 75 awards from 33 vendors. That 2.1% share compares poorly to Canada's NATO GDP share of ~6.7%. We're capturing less than a third of what our economic weight would suggest. And the 2024-2025 data shows the gap widening, not closing.

Rank | Country | Value (EUR) | Share |

1 | Germany | 8.97B | 22.9% |

2 | USA | 4.89B | 12.5% |

3 | UK | 3.95B | 10.1% |

4 | France | 3.61B | 9.2% |

11 | Canada | 842M | 2.1% |

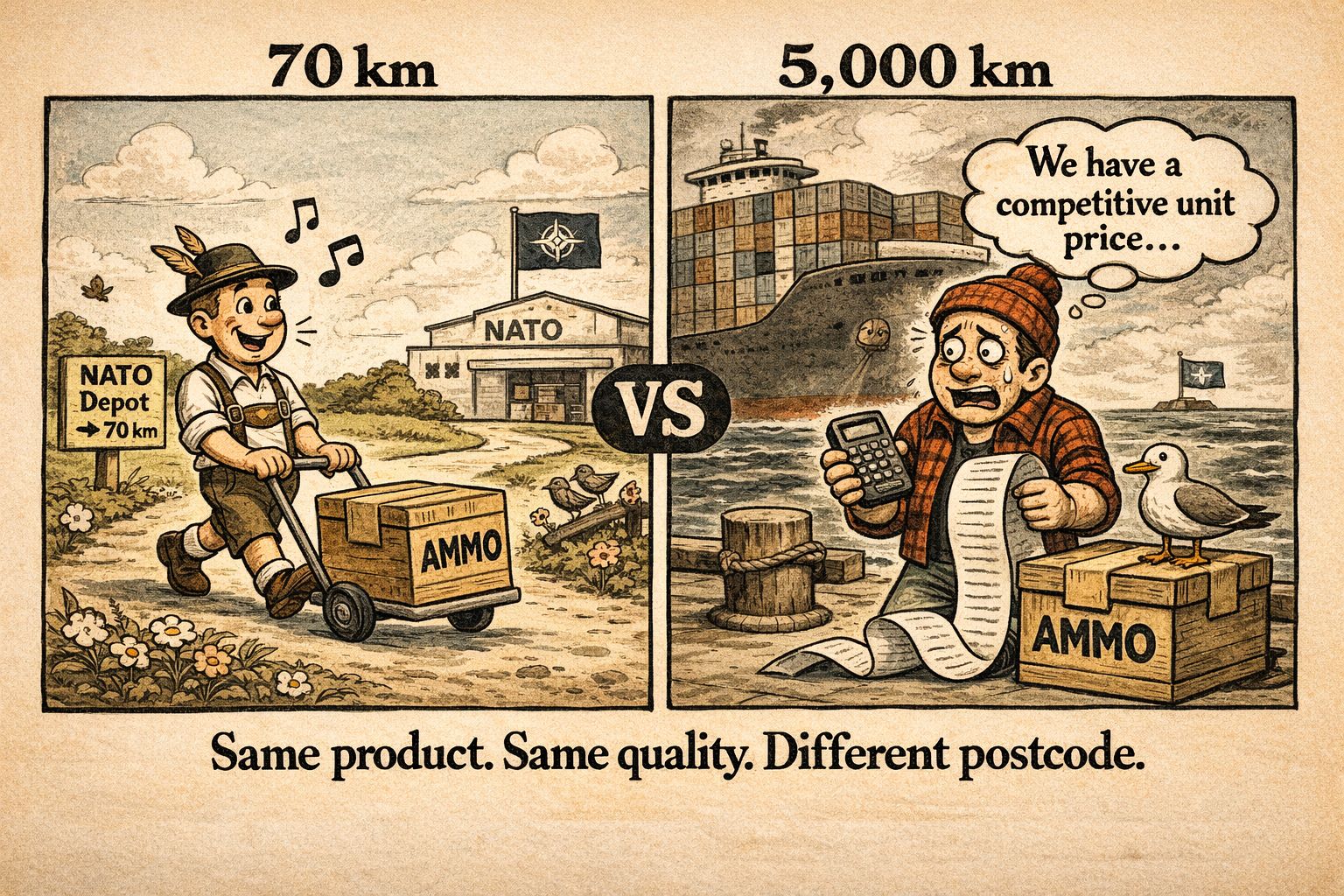

Why the Gap? The Freight Problem.

NATO tenders define delivery at European locations. Shipping cost is included in evaluated bid price. A European factory 70 km away has a massive built-in advantage over a Canadian manufacturer shipping across the Atlantic, even if the Canadian unit price is lower.

Canada proposed having NSPA accept delivery in Montreal and handle onward shipping. NATO finance rules blocked it.

Result: Canadian bids on heavy, freight-dominated items (vehicles, large systems, bulk supplies) are structurally uncompetitive

This effectively forces Canadian firms to set up European production to compete on heavy goods, contrary to NATO's stated intent

Where Canada can compete fairly: Software, IT, radios, electronics, services, and specialized components where shipping cost is negligible relative to contract value.

Who's Actually Winning NATO Work

Of the 33 "Canadian" vendors in NSPA data:

Classification | Vendors | Value (EUR) |

Genuinely Canadian-owned | 14 | ~533M |

Foreign multinational (Canadian facility) | 12 | ~297M |

Recently acquired by foreign PE | 3 | ~2M |

Israeli-controlled / Unverified | 2 | ~8M |

The genuinely Canadian number is dominated by one contract: Cascade Aerospace's EUR 500M C-130 maintenance framework. Strip that out, and indigenous Canadian SMEs deliver roughly EUR 33M total in NATO procurement.

Canadian Standouts

Cascade Aerospace (Abbotsford, BC) — #12 among all NATO vendors globally. EUR 500M for C-130 Hercules heavy maintenance. Owned by IMP Group (Halifax). The kind of specialized, sole-source capability where geography stops mattering.

Magellan Aerospace (Winnipeg) — EUR 12M for CRV7 rocket motors. Sole manufacturer of this Canadian-designed 70mm system.

Canamidex International (Richmond Hill, ON) — Most prolific Canadian vendor by volume: 17 awards across F-404 engines, Apache, Chinook, AWACS, and Patriot systems. Spare parts brokering model clearly worked. Entered insolvency ~2022.

MDA Space (Brampton, ON) — Longest continuous NATO relationship (2015-2024). Supports NATO ground intelligence processing and the next-gen AFSC surveillance program.

HFI Pyrotechnics (Prescott, ON) — EUR 6.5M. Canada's only Pyrotechnic Centre of Excellence. Marine locator markers and training ammunition.

Foreign Multinationals with Genuine Canadian Production

Raytheon/ELCAN (Midland, ON) — EUR 186M in rifle optics. Made in Ontario regardless of parent company.

Ultra Electronics (Dartmouth, NS) — EUR 19M in sonobuoys. One of very few production facilities worldwide.

Vector Aerospace (Summerside, PEI) — EUR 27M in engine MRO.

Some of this is the freight barrier. You're not winning fuel contracts when delivery is at a European depot. But Logistics & Support and elements of Weapons Systems (software, subsystems, electronics) don't carry the same freight penalty and represent realistic growth opportunities.

The Acquisition Concern

Three formerly Canadian companies have recently been acquired by U.S. private equity:

Héroux-Devtek (landing gear, world's 3rd largest) → Platinum Equity, Feb 2025

SEI Industries (Bambi Bucket) → TransDigm, May 2024

Apotex (generic pharma) → SK Capital Partners, Apr 2023

Each acquisition erodes Canada's defence industrial base and our ability to meet Industrial and Technological Benefits obligations domestically.

What This Means For Canadian Contractors

Niche manufacturing wins. The Canadian vendors succeeding in NATO share a common trait: they make something nobody else does, or do maintenance nobody else can. If you have a genuinely unique capability, the freight disadvantage becomes less relevant because NSPA has to buy from you regardless of location.

Spare parts brokering is a proven model. Canamidex's 17 contracts demonstrate Canadian firms can compete effectively as intermediaries. The company's insolvency doesn't invalidate the model. If anything, there's a gap in the market.

Software, IT, and services are the most accessible entry point. No freight penalties, aligned with Canada's tech strengths, and within NATO's fastest-growing spending areas.

Watch the foreign acquisition trend. Every time a Canadian defence company gets acquired by foreign PE, our ability to compete in NATO procurement diminishes. Héroux-Devtek, SEI, and Apotex were all generating NATO revenue from Canadian facilities. Their new owners may or may not maintain that footprint.

Data: NATO Support and Procurement Agency quarterly reports, 2015-2025. Values in EUR. Framework agreement values represent contract ceilings, not necessarily disbursed amounts. Ownership verified as of February 2026.

Publicus helps government contractors find, qualify, and win more contracts with less effort. Our AI-powered platform monitors every opportunity across all government levels, so you never miss a relevant RFP again.